Price Action Reading all Time Frames

Reading price is not a science, But still we have to bring in techniques which is indeed needed to read price action. Price is fractal and there is no fact that is moving sharply down on one time frame and rising on other, It will keep moving in the direction with orders coming in If there is an Institutional Orders are still need to be triggered . But as activity can be spotted on lower time frames, higher time frames should always be supportive otherwise big players can really drive the price to next decision point.

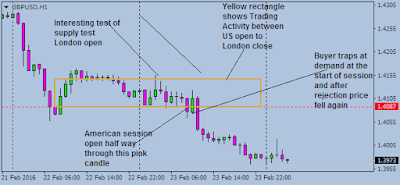

Recent Price action spotted in Eur/jpy on Friday was the real game changer because as I spotted there was some strong synchronization from daily to h1 time frame and price was looking for a trigger to fall which happens just before the market was about to close prior to weekend. That sell-off continue when market open on Monday, and I have try to cover cover all the activity in the chart below as I have emphasis lot on decision making rather than look for trading opportunities in every strong movement.

Decision making has to be there From higher to lower time frame but If it spotted in lower time frame and we saw some strong selling or buying on higher then we just only need a trigger with small risk to spot an opportunity and trade the trending market or even caught reversals at right time. Approach should be there and consciousness is the only difference between making money or remain on sidelines when you should be trading.

Lets look at few examples of the shorts I took On Eur/jpy

We have some strong decision making process in h4 charts, the area I marked with grey box is the decision making process but how market approach it was crucial . At first attempt it already fakeout the first decision point and then test it low approach or can say compression and finally made a new Lower Low. The area of concern is the upside rally has two decision points in which One is consider to be a pause after first rally which was tested already and second was that next demand of that DP was ignored on its way down.

Now For me I would surely be watching the price for next couple of days, how price approach that ignored area of if price found something substantial at the lows and If it did then I would surely look at the pressure on buyers when they buy it low, because remember there is always buyers at lows, but we have to see the pressure how they buy or take the price to next decision point to sell it at the higher price which for me is the way institutional orders hit the market.

Tags:Price is Fractal, Price Action Techniques, Eur/jpy Updates, How to read price charts, Intraday trading techniques, Forex Intraday trading, Live Currency trading