Gold "Rise from Strong Demand Areas" And When we see movement that is going to be highly volatile and starting from inside of the trading range, it’s probably a «cascading effect» - something that is created by «fear of missing out» - many traders are chasing this movement and will lead to fast auction, raising prices higher and higher. In auction market theory it’s called "initiative break", it means that something is happening very quickly, with significant expansion in volatility, and maybe – volumes. But volumes can be not interpreted easily in this case.

When volume is increasing (or decreasing) inside of the trading range, this information can be misleading, because there are too many types of traders participating inside of the trading range – from algos to scalpers, and increased volume can be a result of those guys’ Overtrading

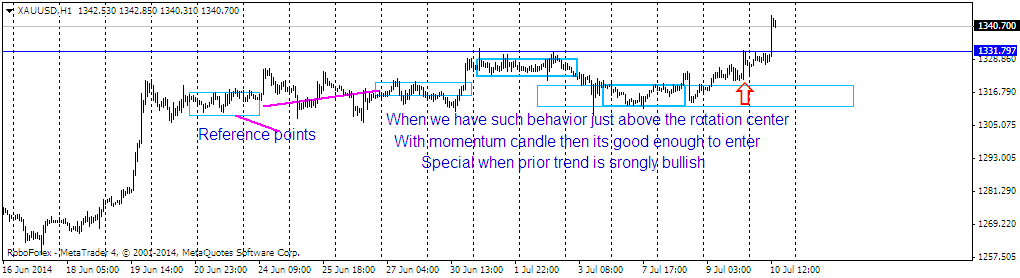

Gold Intraday Update as it has In strong run since low

Gold Intraday Update Cascading Effect

The idea of posting suchAnalyzing too many chart at a Time does necessarily means that you are trying to force the issues and try to capture every possible opportunity that can arrive at any time.

But things are different with "Commodities" traders that you don't have to be worried about anything else as there are two or three precious metal to remain focus as compare to "Scan" Multiple "Currencies", Which is impossible.