What is swing trading? How "swing trading" differs from «momentum trading»? Actually, there are many approaches to swing trading, but I will express my point of view on the subject.

Swing trading is trading on intervals more than 1-3 days, some traders may call it «long term» or «medium term», but in fact, good swing trade can last no more than 4-5 days. Swing trades are usually level-based trades.

For example, if you trade momentum, you can capture short-term overbought or oversold condition of the market (imbalance) and trade-off scenario of inventory correction.

Swing trading basic based on rejections and hotspots areas

I basically trade 2 types of swing trades – «rejection trades» and «hot spot trades»

How do they look like?

In this post I will talk about "rejection trades".

Briefly, rejection is a reversal. It’s that simple. But there’s one small nuance. Rejection level is not a «support» or «resistance» level. Actually, there are no support and resistance levels – there are only areas of support and resistance. And they are usually located where majority of traders don’t seek them.

Important principle:

Before ever considering fading correctional move, you should see signs of support/resistance before. Sun Tzu had said: «Every battle is won before it’s ever fought»

The same is in trading. Every reversal is made before it’s occurred. Weird, huh?

Reversal is just a paradigm shift in heads of market participants. Before reversal, market must have strong imbalance between demand and supply, otherwise no power can drive the market against existing trend (even correctional)

So, to decide whether to join a trend or not, you should see signs of big money buyer (seller). As you know, institutional buyer will tend to accumulate, to slowly build his position. More often than not those guys are not speculators in conventional way – they accumulate position by given price, then use purchased asset in business outside the market.

So, if you see that market tends to show you very well traded levels in the center of the day and poorly traded levels on the extremes of the day, it can be a sign of accumulation if this process goes long enough.

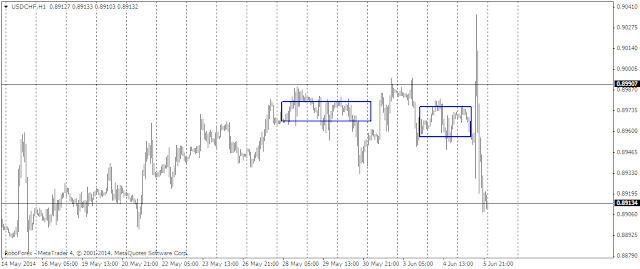

Look at the chart of usd/chf – you have seen signs of big buyer accumulating long here – look how price is leaning to the area 0.8970. How do you think – why market shows strange consensus around this level?

Also, you expect to see «neutral» or «normal» days as the process of accumulation goes on. Neutral day is day with very low tempo and aggressiveness – it closes near its open. Normal day is more aggressive day, yet it also closes near its open. These days also help you find accumulation areas on the chart

No comments:

Post a Comment