Strong holders vs weak holders

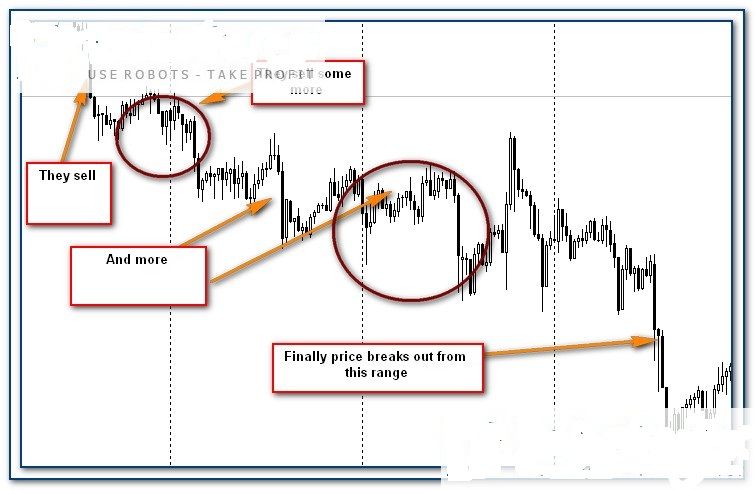

Ok, now if we have distinguished weak holders from strong holders. And what we really have to do - we want to know, at least to assume what professional players are doing. By professional players I mean dealers or institutions that have to consistently deal with big volumes and give their clients at least average good fills. Institutional activity When we are talking about institutional activity, we are talking about strong holders. That guys have almost unlimited buying power at their disposal, but it doesn't mean that they want take money from you, they usually have large order from their clients. It not always means that they want to purchase from weak holder, squeeze them and hunt for their stops. They just want to accumulate position not squeezing price against themselves. First of all, if you look at this chart, how do think, where (on what prices) institutional player was buying (if he was buying at all here)?Expected answer is that they were buying at lower level. But think about their volumes. They are big enough, and they simply would not have enough liquidity to build a position there. They usually have to accumulate - to buy several times, to absorb somebody's sell orders. Otherwise they will not have enough liquidity and make prices grow immediately So, their buying will be distributed within whole trading range:

And the first clue of institutional activity is acummulation on moving market (rising or falling market). They don't have enough order flow going down to absorb, so they have to squeeze prices a bit, but nevertheless they have good average price, not the worst of the period. It's a wave-like process. It ends with a breakout

No comments:

Post a Comment