U.S Dollar Index-- long Term View Sentiment Bullish

The US Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies,and it is the most traded currency against all other currencies because USDX is also termed as International Currency and often used as reserves by countries

Usd Dollar Index Weighted Value against other Major Currencies

It is a weighted geometric mean of the dollar's value relative to other select currencies:

*Euro (EUR), 57.6% weight

*Japanese yen (JPY) 13.6% weight

*Pound sterling (GBP), 11.9% weight

*Canadian dollar (CAD), 9.1% weight

*Swedish krona (SEK), 4.2% weight

*Swiss franc (CHF) 3.6% weight

U.S Dollar Index is made up of 6 Currencies, (eventually 24 because 19 of the European Countries who have adopted Euro as their common currency) plus the other major countries like Japan, Sweden, Switzerland and Great Britain and their common currencies.

As mentioned in the above Example with the 19 countries, euro has make up a big chunk of U.S Dollar Index(57.6%), and the next is Japanese yen which is not a big surprise as Japan (13.6%)is also one of the biggest Economies of the world and rest 30% weight of U.S Dollar Index is shared by other four.

One thing that we must kept in mind that you don't need extra skills to trade U.S Dollar Index as You just need to look at sentiment, swings and opportunity to time your trade and If you are having problem accessing situations then U.S Dollar Index can surely give you idea about the direction and things to come and hence you can avoid choppy Market situations. U.S Dollar Index is directly related with U.S GDP and long term bank policy decisions.

Federation Chairman Mr. Ben Bernanke, Apply Quantitative easing or extended stimulus after 2008 Market Crash, For Few years and hence it really stem the U.S Dollar again its counterpart to strengthen economy and print money to put that money in to economy and offer employment opportunities and stimulus package to buy back negative yield bonds and hence strengthening banks and provide them more liquidity or funds to run bank system smoothly.

There are also some interesting facts that when Euro moves, which really moves US dollar index because Euro covers the most portion of USDX, and because USDX is so heavily influenced by the euro, traders have looked to trade Euro as the highest portion of the Currency Volume throughout globally.

How we can use US Index In Trading Currencies

I hope you have got the slightest Idea, "How you can use US Index in your trading?"

If not, you will soon get an idea, as we all know that most of the widely traded currency pairs include the U.S Dollar. IF you still wandering then U.S Dollar based Currencies are Eur/Usd, Gbp/Usd, Usd/jpy, Usd/Chf and Aud/Usd, Usd/Cad

Well, hold your trigger finger and you’ll soon find out! We all know that most of the widely traded currency pairs include the U.S. dollar. If you don’t know, some that include the U.S. dollar are EUR/USD, GBP/USD, USD/CHF, USD/JPY, and USD/CAD.

So, In broader terms If you trade any of these pairs, the U.S index move and if you dont, the US Index will still give you an idea of how weak or strong the U.S Index around the world. In fact, when the market sentiment of U.S dollar is unclear, U.S Index provides you better picture.

As we all know US Index comprised of more than 50% of weighted value of Euro, Euro/Usd chart can be exactly inverse of U.S Dollar Index.

Technical Analyze of USD/jpy

U.S dollar is on the Radar Since there have been talks of Fed Rate Hike and it has picked up since the first rate hike in the last December and hence I always recommend staying long instead of just waiting for things to happen or most of the moves have been finished when the action is performed.

US dollar future to dominate pound exchange rate in coming futureI would like prices of pound sterling to remain in long bearish mode and it could even turn out to be best run of Us dollar future against single currency of U.K. also referred as british pound.

US dollar update 4th October 2016.

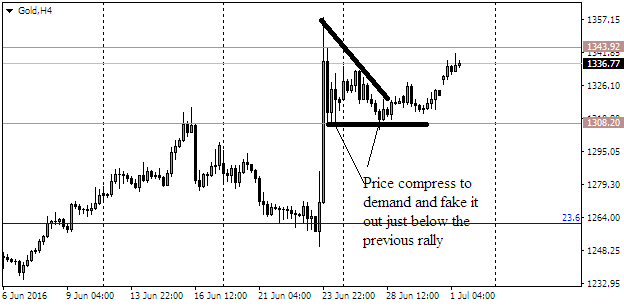

US dollar bulls very cautious ahead of NFP data I have seen lot of bull rallies of US dollar fake about the recent range and I would like to see this failure again and would look to see the reaction at the low of range again.