Blog is about Forex Trading for beginners. . Build forex trading strategies and make a living with Forex Trading.supply and demand price action, supply and demand zones, Price Action Techniques & learn to trade like banks and institutions

Friday, September 23, 2016

Long term updates of Euro-dollar. Approach to trading levels ---Forex trading strategies

Wednesday, September 21, 2016

Us dollar Futures and Federation policy---- A strangulation for traders

Wait and watch policy for US dollar traders and don't expect anything

We can witness bit panic rallies today from on 21st of September 2016, but I won't expectation anything more than retail traders panic rallies and don't think any institution or banks would enter the market and make those rallies much smoother one.I still waiting to federation to be more dovish today and area of 96.40-50 hold any upside rallies and then we can soon witness US dollar to find headwinds and rally towards 94.90 area and I would post a video and update If we don't see upside rallies which break through 97.10 area, but I have never witness such extended consolidation and may be us election could be the prompt reason that come to my mind and that is how I approach my trading activity and hence we still can see downside rallies towards the mentioned target and today retreat from higher levels could just be the start of downside in coming weeks or even months.

Also watch out for RBNZ rate decision couple of hours after FOMC

Saturday, September 17, 2016

Reason of failure in Forex --- Trade Possibilities not expectations

There would be certain eyebrow raised when you read the title of this article. But there is lot of difference in expectation and trading possibilities and that is why lot of traders do tend to fail and most probably 90% of the traders fail and the reason being not on the right track but keep looking for assistance of indicators fibos trendlines but do you really thing there is any need of such tools to be used in trading or chart tells you different story altogether when you just look to see what is being presented to you.

Reason of me ignoring mechanicals systems like EMA's RSI and Fibos

I started trading in 2009 when I was presented with certain methods of predicting the price and different failure mechanical system brought me to the reality and wonders of Trading and I started feel about the system being controlled by few bunch of individuals providing liquidity and facilitate trading but there has to be few ways where they trap retail traders and I started working the real manipulation of trading and found the real way of trading and meet few individuals who thought the same way like I do.

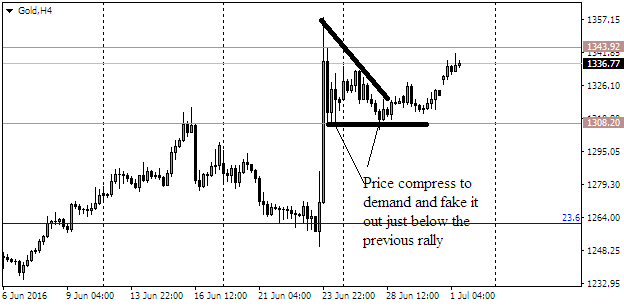

Gold Index futures technical analysis and long term view

I have several plans to trade gold in the long run and I would still think that gold has fair way to go to the upside before it crashes down once again But I trade possibilities but not expectations as it is mention in the article heading as well. I have prepared a special chart video at the end of this article which will show How to approach trading and use technical for your own benefit but if you don't consider risk reward and money management techniques then You should take a closer look at this chart.

How I manage to apply money management rule in my recent trade setup of gold futures

>

When you see price spiking off the consumed demand or even climbing after engulfing the source the most probably it will fall of the new supply or even ignore demand and supply level historic levels or levels where price had history and that is what Gold has done and after engulfing the source of the upmove price has rejects off the capped supply and Now I would watch closely how price behave of 1302 and 1351 levels and inbetween there are no trading levels.

Wednesday, September 14, 2016

Forex trading strategies- Education portion and analysis of us dollar

In this chart I have explained what is risk reward and what is potential fakeout and complete understanding of the chart and you don't need to wait daily for such setups as they are properly planned and you just need to understand the logic and then react.

Please do check the video series of my channel and I would every effort to daily update everyone about trades and potential opportunities. Do like and subscribe my youtube channel

Tuesday, September 13, 2016

Qualities of a Forex trader - Timing Reward and good money management

Hi traders,

I had few weeks off and again here to update the blog with the best of the services I can offer. Today, I am here to discuss with you the qualities of a traders which you or me all need to work and It could be really daunting task to change the habbits but once You are good at doing what professional traders do, You don't had to follow the instructions from anybody else.

Forex trading is rewarding but facts we all must know

There is no denying the fact that trading is rewarding and that is why lot of institutions organizations are putting lot of efforts daily to facilitate trading and take their part and they don't care what others win or lost and that is the best quality a trader can have. You should never look for what you put at stake or what others are doing and you should know what your strengths are and should always look to act when needed.

Risk Reward in Trading is the best thing a trader can work and if you are strong in getting high rewarding setups, and look for the low risk opportunities and have patience to watch out for such setups, then that it is the best thing we can do. A setup below really explains it all for a trader and such setups are rewarding when there is complete understanding of price action and you have such strong Risk Rewards and I always like 10 times or more reward and that setup certainly had the potential.

U.S dollar futures looking for direction

Its quite a while since we have seen rallies from dollar index and its counterpart Euro and reason being the dovish Fed and key data awaited and no hikes in recent months after the first hike in December last year, But I think its just a matter of time when Dollar future will find direction and when It rallies it would be the strongest in the recent weeks and months. I have a trading plan to trade dollar Index and Gold Futures and I will keep the blog updated from time to time or when the opportunity arrives and that will help you to find low risk high rewarding setups.

Chart

Gold and Silver Looking for breakouts up or down Key level for Gold Future 1300

Price has been trading in range from 1300 to 1380 for quite a while and I am still expecting that support to hold the price for a move towards 1340-55 area from where we could see another rally downwards from the Gold and there are no global clues of improvement and signs of growing global economies and economies like China, Australia biggest importer of gold are struggling from growth and hence banks are looking for tightening and it really needs a lot when they start expanding their balance sheet or we can see this type of reaction till the U.S election but I am expecting the ranges might be over in a week or so when we enter the last quarter of the year and that for me is always the most volatile quarter of all the year's trading activity.

Trading signals or recommending trade opportunities for the week 12th september 2016

Saturday, August 27, 2016

Time to know about potential fakeouts l gbp/usd overview for the week 28th August 2016

Trading has been quite choppy during last but as chart speaks to you and there was no institutional and Banks involvement was seen and hence we don't seen price move strongly in one direction. Up and down both sides price found support and found sellers at the top. I really found a chart of gbp/usd, which I found of my liking and I think it will be better off to share.

Price Pattern to trade Potential fakeouts

If you take a look at the chart you will find reason there was strong rejection of the particular area on the top marked with blue rectangle and when price bounced of the lows this area hold the price for three consecutive rallies and then finally we see a break of the area and then price retreat of these levels and It was quite evident that we will see some reaction when this area will be again test and hence price found resistance again.

Friday rally was very low risk and Now I expect price to find support between 1.3120 and 1.3040 area, and rally again to 1.3280 for a test and this time If it got rejected we will set pending sell limit orders around those levels for another rally towards 1.2950 area, but IF price could not found support then we won't bother to look at this potential fakeout.

Saturday, August 13, 2016

ways to find true trends l exit and entry rules in Forex

Trading has been quite choppy and reason being the expectations and japan and Britain focus has now again been shift to Federation and next meeting will be a concern that september rate hike talks would be strong and we can see a hike next month when federation member met for the policy discussions.

Ways to find true trends

Its always important for us to know the trending pairs and play a waiting game till the price itself talk about the next move. No laughing stroke, as I see chart talking about the next move and that is what a trader has to look out for. Recent price action in Aud/nzd tells me that parity is again on the cards specially when so many rejects and overall bearish trend is roaring and we see another rejection Friday and test of 1.0700 area will be rejected once again and we can see 1.0450 and 1.0270 are and that will be a much better trade entry with no risk at all.

Entry and Exit Rule

Sell stop at 1.0700

stop around 1.0735

Target first 1.0580

Target second 1.0450

I really want to test If price has rejected with purpose and supply from 1.0700 has been tested twice and reason I am quite confident that Price has engulf the last flag which was protected while it was tested last time and this time price has strongly rejected from the supply again and this time engulfing the demand strongly and that is the reason any test of 1.0700 will be rejected and that is why I always trading pairs which are trending and have clear swings and have least risk involved.

Swing trading is not easy but logic behind Swing trading is quite simple and you don't need any help of Indicators and other technical tools to spot the involvement of strong money as they hardly watch any chart to move the price and they use charts only for one purpose and i.e stop hunting. That trade of Aud/nzd can really help you trade naked charts once I post the chart in my next post of trade diary for the week August 14th 2016.

Friday, July 29, 2016

How to find Imbalance on a chart-- Supply and demand Indicator

It has been quite a busy week but at the end of the week as it happen mostly on last trading Friday of the month and last day of the week, currencies starts moving erotically and usd/cad was no different.

But what different has happen as it was on the cards and when you spot smart money around you can expect movement in every correlated or non-correlated assets class pair and as Canadian dollar is directly correlated with Crude, whose downside pressure was on the move suddenly we see profit taking and GDP numbers from US and Canadian Area was surprising factor in the overall context and hence strong movement was already witness on the chart.

Ways to find Imbalance on the Chart

As you all might wonder, what is imbalance and I have stated it so many times in my blog Articles that strong trend reversals out of nowhere and then minor bull bear fight to move the price is the "Imbalance", area on the chart and we all must eye such locations and canadian dollar recent up down movement was a great clue of something will give away at some point and today was the day.

IF you see the chart clearly I have mention two areas where strong set of orders are seen after price make a new high and fail to hold on those highs are first clue of collecting all the buy orders against the big sell orders and this week new multi month high was no different as price engulf that with pressure and after that you just have to find the approach to supply and QM area to short and where risk to reward should be atleast 5-6 times but pair has fallen more than 150 pips so that rewards was never expected.

Wednesday, July 27, 2016

How to Master the Art of Swing & Scalping Trading Techniques in Forex

Its has been a struggle for new traders to how to choose from swing trading and scalping as short term risks are always better for them to get small profits and build their accounts and they try using lot of indicators and expert advisors to see the results if it suits their trading style and yet it never did they never been able to admit that there is no such path of success that leads to shortest way to get there and scalping is such an illusion that traders find themelves very difficult to get out of those short term money making techniques.

How to use selective approach and be versatile in Forex

As a young trader, everyone use to try everything, atleast for first few years and it has been happening to everyone of us, not to every 2 or 3 out of 10 traders but 9 out of 10 traders using same techniques and mistakes over the years, but technology has changes and everything is made available so easily these days, but choice and control depends on traders as it always been the case.

But how and when is always the biggest question arising out of minds. So, lets start this journey with few checklists that we always need to be aware of while picking up choices between swing trading and scalping.

To start off, scalping is a technique which we use to trade to pick up small profits by entering a suitable pairs for several times a day .let's say scalp euro for 10 pips with stop 3-5 pips and do that 3 to 4 times a day and you succeed half of the times. So risking 5x4=20 to make 10x4=40 which means reward should always be 2 times or more.

In the process mentioned above even If you win half of the times you still make 20 pips and even if you loss three you still loose only 5 pips for the day and it is easy to recover next day and hope you win 3 out of 4 and that process continues and you start to believe in yourself that slowly and surely you can built such techniques and from time to time apply filters to make these scalping technique much improved and easy to use to identify setup to make a sound living out of Forex.

That statement tells us the importance of money management skills that we use to implement in our trading no matter what strategy we use and no matter which trading style we adopt but now the question is which strategy is so powerful that help us identify the direction and pinpoint stops and profit target that we can use the entire day or even a single session on day to day basis.

Simple answer here is adaptability and our accessing power tells us pairs that are trending and for this we should not be limited to a single cross and pick multiple pairs that are trending and find trade locations which tells us the probable profit potential.

Simply pick gbp/jpy and pairs which trend strongly everyday and yen paris hardly offers extended choppiness and are best to use while swing trading and necessary tools you need to pick up trend with entry and exits are being discussed in details below.

Necessary Tools to pick for Swing Trading

You can pick any indicator for scalping and for this purpose I pick bollinger bands, RSI and fibonacci.(settings are not important as you can use default platform settings)

Saturday, July 23, 2016

Trade Diary for the week july 2016 l Gold Future Euro Exchange rate.

It quite a busy outing altogether for currency traders with risk on and demand for safe heaven this month and I still would expect situation to remain subdued for the risk on trades.

Trade Ideas for the Gold Futures

I posted two posts on gold future updates around 1380 and 1332 and both the conditions were fulfilled and price is now in PA zone and I would expect price to remain volatile and react to recent new supply and I would expect the rejection and towards the target around 1305 area

[Also Watch :- Recent Articles on Gold futures ]

Euro dollar trading FOMC Statement

Euro dollar is moving in narrow range and trading just around the range low ahead of 1.0900 support and I would like to keep an eye if there is any rejection from that support and price manage to stay above 1.1050 for a move towards the range high and then possible new direction to new high above the range.

With recent Price Action and FOMC statement due to release next week, I would like to see price reacts to support and we can see bullish price Action in Euro, but still price action is very bearish and I would post an article after the report will be published and Euro is surely to find direction after the report as there is not a lot happening from ECB, and traders are really looking for Fed officials comments for the direction in Euro exchange Rate.

This week is full of fundamental analysis with focus shift on FOMC statement as talks of September hike is really putting risk on as after what happened after "Brexit" referendum has put lot of pressure on Federation and If there is any report telling that of shifting the rate hike to next quarter would really put pressure on U.S dollar and it can retreat from recent levels and Australian dollar would be bought from the recent levels but due to recent talk of Rate cut and recent price action can dilute the comment and we can see price don't react as expected.

Focus is shift on next RBA meeting next week

Trading such scenarios is quite profitable when Price Compressed to supply and rejection are followed by choppy and sideways price action as Pair look for direction ahead of strong fundamentals report and If expectations are not met price usually lack supports and bearish pressure is quite imminent.

ChartCanadian dollar is all set for new direction as we saw a break above recent range and retreat from these levels but Price has strong support as mention in the blue boxes in the chart and If price manage to break below these areas then I would like to see the approach towards the supply and I would still maintain my bearish outlook for the canadian dollar towards my next target 1.2630.

How to trade Rejection in Forex with recent price action in Canadian dollar

Price has manage to react to the strong areas and rejections are quite volatile and this confirms that new high would probably show the same momentum as it has show in recent weeks.

[Also watch:- How I manage to Pick bearish Price Action In Gold Futures ]

Thursday, July 21, 2016

Comex Gold bulls facing headwinds around 1344- Trading Gold Futures

Hi, Quite a while since I update the blog and the reason being quite a dull and choppy price action and now I am watching gold for the past 7 days or so and recent price action facing headwinds If we see a rejection of 1342-45 area, and this bearish rally would continue towards 1295, which is I think strong handle and there would be a decent fight between bulls and bearish to protect this area, but for the time being focus has shifted towards 1345 area and below 1327 which I think need to be cleared first and then we can see more bearish price action to follow through next week.

Rallies followed by Reversals

We do need to understand the overall structure before we can make any decision in tradingReason I am quite skeptical about this Gold future rally is that Whenever we have strong liquidation break to the upside, we have seen substantial selling interest which increase with minor rallies and Whenever we see price approach a particular supply or demand area after clearing opposite demand aka supply, we see price tend to behave dramatically when It finally gets to the origin of the move and this time we already have a retest where we see compression towards 1345 area, followed by rally towards 1310 area, and recent rally is strong from the lows but I doubt whether It will continue.

Wednesday, July 13, 2016

Trade alert Australian dollar possible push towards 0.7714 l Trading employment data

Tuesday, July 12, 2016

Canadian Dollar Trading BOC statement l Whatever the decision Canadian dollar will collapse to 1.2470

Canadian dollar is waiting for BOC members to gather for the policy guidance and make forecast about rest of the year GDP and other policy decision giving canadian dollar directions.

Whatever might be BOC decision Canadian dollar is about to collapse

I won't take much time explaining you the fact why I think Usd/cad is about to collapse strongly for the rest of the week or even month, below is the chart that explains it all.

You might like reading:- How to spot Clean set of orders

Also Read this :- Gold Future Long term view

Learn to trade currencies like a Professional

Monday, July 11, 2016

Learn to trade forex like banks l Live trade Example usd/cad

Trade currency is like a challenge to everybody specially If you have been trading for a while with no success and still quite dedicated to learn and adapt and prepare yourself, but still you need to think out of the box and learn tricks that strong institutions and banks use to trade and I have done my best to put it all together and everyone out there because I know how frustrating and hectic it could be to trade currencies for years and yet suffering from directional bias.

You might like reading:- How to spot Clean set of orders

Currency traders in years develop millions of trading system and only certain number of traders use them to make a living off Forex trading and yet we have all the time in the world to learn trading but we look for shortest and easiest way to approach currency trading and hence look for trading gurus to help them and urge for sharing their trading methods and strategies, but after certain number of months and years we did not even get any success what we work hard for or what we deserve and reason being the logic and when we look to trade multiple mechanical systems and multiple self-failure prophecy systems.

Also Read this :- Gold Future Long term view

Look at the chart below and you would understand that how easy it could be to learn and read a currency chart like pro and make a living and successful trading career. step to step guidance is very important and I have put every effort to make it crystal clear and for me patience is the key until the smart money pull the trigger and we just need to find trade locations and half of the work would already be done and you just need to watch out for the tricks that happens afterwards

Learn to trade currencies like a Professional

This chart is a clear example of how we should target a pair which is approaching strong demand or supply area according to our analysis and this would put lot of stress out of our mind to target and analyze multiple currencies charts, indexes, futures and commodities. I have post a small screenshot on the left of the real usd/cad chart which went exactly as shown in the diagram. Price could react to certain price patterns and could reverse or look to continue above the mention target but it has already spike from as low as 1.2890 and currently trading around 1.3120 so it was a nice profit overall. I would post couple of more charts in recent week only for education purpose.

Weekly Price Action Analysis for the week 11th July 2016 l Canadian and BOE policy eyed

Hi, traders We already had quite handful of events in the last couple of weeks and it has been no different this week with volatility will again be on the higher side with two large banks gathering again to discuss their long term policies and future forecast and specially Bank of England would be under tremendous pressure for future guidance as they will have to keep everything on track for new policies and with new headwinds coming their way. So, it is important to look out for other pairs which have direction rather than just looking for these two pairs as smart money will keep looking for stop hunting and pairs will suffer from clear direction at new high or low.

Price Action Analysis of Euro/dollar and U.S. Dollar index future

Price Action analysis of Eur/usd and U.S dollar future and they will be under radar and look or the help of risk aversion for the direction as they are lacking fundamentals at the start of the week but at the end of the week U.S Cpi would surely fuel the prices of the both euro and dollar as September hike would also depend on Inflation numbers.

Technical portion of U.S dollar and EuroSaturday, July 09, 2016

Trading Gold Futures Price Action l Fibonacci retracement and price action levels

Its been target oriented week for usd/cad and Aud/cad pairs and Now the focus from there shift after the news section settles down and we can see new cash flow in the Currency market as talk shift to Fed's september rate hike after upbeat Non Farm Payroll last Friday. I have prepared a report on Euro dollar, pound dollar and commodities.

Fibonacci Retracement levels for gold futures

Weekly chart of the Gold Futures refers to unfold correction and retracement levels towards 38.2% and If we see an rejection from here then probably we will witness a impulsive rally towards 1295 levels and from there we will see how price unfolds and If this assumption is right and we see a break below 1295 level and this will confirm the top and our next target would be 1250 and 1198 level in coming weeks. But we will have to be patient and wait for the price action to show some sign of top.

Read Gold futures price Chart and understand every move

Gold futures has some strong history and open interest at historic level where price had fakeout the bull rally and strong rally after clearing supply with every move was a clear signal of new buyers found there at level and that is what I try to mention in the chart and Video below will really help you understand the "law of open Interest" at historic price action level and Now we need further price action to see if Price has reached the motive or target smart money was looking for and I would post an update If we see another level of interest or trading opportunity.

Wednesday, July 06, 2016

Trade Updates post RBA statement l Trading True trends in Forex

First of all Look at the update I posted prior to RBA statement on 5th July 2016.

Australian dollar bullish sentiment RBA Cash Rate Statement

Just hours before the release I update the blog with two pairs looking strongly bullih and those were Aud/cad, and Aud/chf and they were trading at 0.9626 and 0.7238 relatively. I took the decision to go long because relative decision were made prior to the release and it was just noise that was cleared after the release and pair start trending again.

Updated Price Chart of Aud/cad

Price was trading around 0.9626 area and risking 40 pips would have been very good idea as I posted on the previous article as decision was already made and there was just a question of price faking out the area for buy limit to get filled and it does reach to 0.9620 level which filled up pending limits and still was the cheapest price after moving market accumulation.

In next few hours, I would post few videos on the trade ideas and then you all would have some idea how I went about my trading decision just prior to the strong release and I Just confirm the swings and look for the possible reward and still I think pairs have quite a strong way to travel specially Aud/chf looking strongly bullish towards 0.7560 area.

You might also like to read :- Real time Trading Signals

Updated price chart of Aud/chf - News Trading

Tuesday, July 05, 2016

Forex Price Action tells us about clean set of orders l Forex Price Action Techniques

I have published multiple articles on this blog to find you locate the Price action patterns which helps us in decision making and those areas could be consolidation,swing high or low, broken support or resistance rallies, drops and it helps us in locating true set of orders and levels that helps us in building strategies.Forex price action is really about finding levels or areas of concerns which help us find true set or clean orders and that is where all the trading strategies should be built to help us locating those levels.

Without complete knowledge of price action and clean set of orders, traders can not bring technical analysis knowledge to find out location to manage the risk and If they are not aware of the source or origin of the move, there is no way one can find no risk or low risk opportunities to ride the complete swing. Traders applied candlesticks patterns at support resistance, swings or important levels specially fake pin bars, engulfing patterns and look out to find the true trend.

Time to add more longs to usd/cad existing entry

I have decided to one more long to usd/cad around 1.2980 area and earlier entry was taken around 1.2890 and both the stops are now placed around 1.2940 fro free ride to test 1.3090 and 1.3175, but it all depends on how price unfolds and how price retests the area around 1.3090.

Monday, July 04, 2016

Australian Dollar Trading Cash Rate Statement and Retail sale l Trade Diary for the week 3rd july 2016

Trading has been bit thin after the storm of Brexit that took all the currencies in to strong selling zone but Australian dollar has recover and reach to the level prior to the decision made by U.K voters. Outlook somewhat is quite bullish and with no expectation from the board members as they would like to keep the benchmark cash rate to record low around 1.75 for deposits, But there would be a RBA statement after that which would be a point of focus for traders.

Trade Ideas for Strong trending Pairs.

Trade recommendations for aud/cad and aud/chf which has been trending nicely after failure to hold the lows and looking to test the high and this should be a good time to add fresh longs to existing positions.

Friday, July 01, 2016

Commodities updates - Gold Futures targets and Crude oil watch

Gold futures longs with no risk was the best option to start off the week as price again fake the previous demand and create new demand and rally and last two days bull rally today tests 1341 area which was the first rejection point in the strong risk-off rally after "Brexit", panic offers new safe-heaven demand for gold and other commodities like silver and copper.

You might also like to read:- How to Trade Fibonacci Retracement

Gold and Silver are still the best option for longs in risk-off

Trading is close on gold and other commodities for Monday due to Independence day in U.S, but still I have enough profit in gold and looking to wind off the week with single trade that rally as expected. I would eye on silver now and would post inFibonacci Retracement section for next possible target for both gold and silver.

Monday, June 27, 2016

Trading Gold Futures- Updates Fresh Longs after Friday Rally

Gold has rallied up mostly in a single day in past two years and that is understandable when traders are looking for safe heaven after Risk in U.K. and recent price volatility in gbp crosses all around, traders are looking for safe-heaven and reason gold fresh longs can be seen again today and rally to test the multi-year high around 1365 can be tested again.

Trading Gold Futures amid safe-heaven

Situation will be volatile, and I am expecting no respite till a resoultion is reached out or memorandum about how a debate and discussion will be reach to a decision that on which conditions UK will left EU and any news coming out of camp would certainly push panic in currency traders and price would behave erotically in recent weeks or even months.

Trade Diary For the week 27th June 2016 l Updates of Usd/cad

Friday I update the blog about the setup in usd/cad and risk of only 30 pips, brought another test of 1.3086 supply and now I am taking profits around 1.3050 area, and would look for the strength, If price test the area again and would like to see the approach.

Take a look at the post Usd/cad Long

We all know about risk in Currency trading, which drives the market broader way, but only few of them offer opportunities such as this and When it start to test important areas with strength, then it always do offer such low risk trading opportunities, which is well worth to try and make them work for you.

Updated chart of Loonie

Friday, June 24, 2016

Trading is all about managing your risk Building Risk management strategies

Trading any market can be a challenge, and it often test the versatility of a trader but IF you have built up strategies that can help you understand lack of involvement or not too much liquidity or volume behind the moves, then you certainly can ignore various global risks that drives the market sentiment for longer period and that is what happen after "Brexit",Vote where "leave" camp dominates the voting launchpad,but I seriously never expect that much response to those results.

Bring simplicity to the trading and manage your risk properly

I expect the recent failure to close above strong supply is probably is last step towards eating up the remaining sell orders that has been left filled while price makes a large move down and it was the only supply in that range so to react with strongly bullish move price had to react and that is exactly what happened and now after this supply is consumed we can see move towards the earlier high above that 1.3115 area while price left this area and Now because of the low has been tested with even strong demand we can see new buying interest that make a new high above that and that could prove out to be very substantial move as Next area to watch is 1.3279.

Best way to manage any trade

There are numerous trading opportunities available on the table daily and you lookout for high probability trade and after you find one such trade, the next thing you do is to look manage your trade and manage the risk properly. There are not too many traders around who have used Money management as there prime tool to tackle the market and as in result high probability trades turn out to be a losing one.Have you ever try to add new position to your existing profitable one, specially when you trade in strong trending conditions and you think market has offered one pullback and good area to enter the market to make more profit.

Logical way to add another position to your profitable one

IF yes, then how would you mange that trade itself,as I often use to add another position If earlier position has given me 2 times of profit what I use to risk when I enter initially, so that means risking only 1 part of your profit to make more. e.g If you risk one part of your profit to enter at pullback and put the stops at your initial entry and IF in any case you stops get hit, you close that trade at breakeven, but this is the best way to manage your trade of making complete use of your trading plan and logical way to enter and exit the market.

Scaling out your position

Another way to manage your trade is to use "scaling out", which means that you reduce your position size as compare to what you enter initially, but it is not a good idea because it can totally take potential profit as you won't allow so many trending conditions daily and hence make full use when you are given a chance. "Scaling Out" is not a good idea because IF you enter with 2 lots and price moves 100 pips in your favor and you close that trade and again enter with 1 lot with the same stop at the price of your first entry, This seems illogical way to as you there is big chances that market went in your favor (specially when market is trending strongly),another 100 pips and you make much less that your first anticipate and this skills are must to have, If you want to use Money management to cope up with your directional bias.

Tuesday, June 21, 2016

Foerx Strategies-Fibonacci Retracement l Guide to trade fibonacci retracements and expansions

In this section, I will explain How to use Fibonacci with combination of RSI to improve you trading results and trade trends most of the time as Fibonacci is a handy tool that let you know when to enter the market and use accurately over time by some legends and further improvement of this method has been seen.

Tools you need to use with Fibonacci Retracements method

Fibonacci is the most widely used term and every Forex trader new or experience is familiar with the term. Fibonacci is the tool that really can help you find true trends, pullbacks or Retracement and signal continuation of the larger trend.

Fibonacci retracement and expansions are the handy tool for entry and targets

We have seen people use fibonacci in elliott wave, harmonic trading and chart patterns for intraday and swing trading. But you need to have complete knowledge of swings on higher time frames as mostly fibonacci is used for reversal and one can really chase the trade too far If one has not experienced enough to know about Risk management and trading mechanical systems.

Here you see 5 minute chart of nzd dollar where price is strongly in uptrend after retracing and you just need to put RSI of (14 period) and it should be above 50 which is neutrality period for traders and look for 5 minute chart and find a swing that is atleast 40 pips and mark this area as A, and Now you just need to find out If price retrace to 61.8% fibonacci and mark this area as point B,and If price rejects from there and close above 78.6% fibonacci which is point C which is our entry price and don't remember to put your stops and it should be place just few pips below 23.6% and in this case Entry price was at 0.7149 and stops were placed just below 0.7116 risking just 33 pips and there is another rule for your target.

It clearly upto you If you look to go 1:3 risk reward or whatever ratio you like, but If you want to stay in the trend for longer periods the You just need to find another strong swings of 40 pips and when you find and price start to retrace to 61.8% fibo and rejects from there you can simply put your stops just few pips below 23.6% and hence locking the initial profit and look to do the same and this is such a powerful system that If trend is too strong you would ride that trend for 2-3 days with risking not too many and locking your risk just on the day you enter.

Power of fibonacci trading Updated Chart nzd/usd

Our initial entry was around 0.7148 and stop was placed around 0.7115 so we risk 33 pips to get atleast same amount of pips in our favor.

We were given second entry at 0.7172 and then we luckily get our stops around 0.7148 which was our first entry price and that give us confidence of smart money involvement and levels at 5 minute chart.

Third entry was offered around 0.7232 and that time our stop and trailing stop is around 0.7217 and here we can look to book profits or can risk what we afford to risk earlier which was 32 pips and because of the fact swings are so strong it is risk well worth taking and see if we can take four time reward which is very rare on intraday trading chart.

If you would have risked 32 pips initially and set to breakeven at first swing at 0.7148, and now you can look to trail your profits around 0.7217 and trade the trend If you can risk 32 pips more to gain more otherwise you would have already got 100 pips target which is 1:3 risk reward and that is forex money management is all about and you just can't just let an entry go buy when you look to ride most of the trend.

Let's repeat the entry and exit system once again.

1. You should look for strong trends where Daily RSI should be in positive slope up or down.

2. look for 5 minute chart and look for strong spike of 40-45 pips in the direction of daily trend.

3. look for first retracement to 61.8% and then look for price to close above 78.6% fibonacci and put the stops few pips below 23.6%.

4. Exit only when you find a strong spike simply retraced below 23.6%. IF you get second swing similar to first one and that repeat the clause look to set price at breakeven .

5. When you get Third entry as I show in the above chart then you can look to book partial or full profit as you should not show greed and profit is alteast 1:3 when you enter first.

Saturday, June 18, 2016

Currency Outlook For the week June 20th l Trading Brexit Referendum

It has been really quite a rally since I posted the chart of gbp/usd and it has manage to engulf the decision point and supply above around the 1.4750-60 area is not far away and If price manage to react from here and ignore this decision point completely then you can certainly look out for longs around the 1.4650 area, if price tests this area with purpose. Chart below is prime example that only price decide whether there is supply or demand and when it approaches and rally is too strong, we should be aware of such price patterns that don't care strong levels but look for reaction only when price manage to test when there is no subsequent demand or supply area left on the opposite side.

Alternative scenario of Gbp/usd if bias turns bullish from here

This scenario was not favored at all but we have to respect the sentiment and if Brexit referendum failed to reach any decision and Britain manage to stay in Eurozone (Which I think is the best outcome for global market), then pound sentiment will again turn strongly bullish but volatility will remain subdued and price will rally for sure. Just another thought process and waiting game to see how price behave at new high or higher low If demand remain protected.

Monday, June 13, 2016

Fear of Brexit driving Pound into extreme levels of trading

We all have seen another volatile week for gbp/usd, reason being the news out of Britain Area regarding "Brexit" driving traders in fear of missing piece of puzzles, and hence some strong buy and sell orders but for me, its always been discipline and most crucial traded levels of rejection and one I have my eye on right now is crucial 1.4650 area, and that has been the point of focus for me right now .

Pound overall picture from Technical point of View

We have seen some strong rejection from highest levels and this can be another fakeout of demand and If we see some rejection in the box above in blue we can see massive selling at failure at supply levels, but we have to be patience and we have to wait for the sellers take position again from these levels as we have flipped again into the confluence of previous bull rally and rally to 1.4320 area, seems bulls hold the position again or we can see another phase of distribution around the levels I mention in the chart.

Focus has been shift to the two volatile events in the coming days and one of them is this week FOMC minutes, which has been the driver of US dollar Index Future at large and any statement made or failed to reach the set targets of inflation or employment numbers will give USD bears enough chance to drive the price lower and this can be once again the most favored scenario, but we will have to wait for the board members to justify their reason to hike or not to hike and this can really be volatile if there is no proof of another hike in coming months as employment numbers were very disappointed this month.

Currency Updates Buy Euro on Dips

It has been volatile week for Yen Crosses and fair risk after comments from Yen officials that they don't need further stimulus and happy with the recent recovery and these comments seen decent Yen appreciation, but focus is now shift on next week big Brexit referendum which will decide the fate of Britain residents, that whether they want to stay in Europe or would like to exit and that can really create panic and moves can go either way, so be patient and wait the storm to settle and it would be better If you don't schedule any trading activity during the next week because of uncertainty.

How to Trade Forex mean Reversals with logic and Reward

Tuesday, June 07, 2016

Trade Alerts

Forex Technical Update-Live Trade Gbp/usd 06 June 2016

Pair has managed to hold the gains after huge rally downwards to start of the week, but has show strength and focus is now shifted towards the high of 1.4750-60 area, I would wait for pullbacks towards 1.4450-60 for any retracement entry. Check the post and check the trading levels.

Live Trade Update-- Aud/jpy 05th June 2016

long entry was recommended around 79.55 levels and target was set around 80.67, Pair has manage to reach 80.40 and waiting for 80.67 first target to be achieved soon and from there new update would be posted.

Forex trading strategies-Fresh Usd/longs

Trade was recommended earlier after rejection of 1.2892, and idea was immediate rejection from strong supply in to demand and rejection offers very low risk reward opportunity and that is the reason I buy it around 1.2920 and took profit at 1.3050 when market rejects once again from the same area on Monday. Trade Update usd/cad

Forex Techncial Analysis Gbp/usd l Trade Alerts

Pound has manage to fake the previous price Action around 1.4356 and manage to breach the high of post NFP payroll data. Focus is now shift towards base of the current pause in rally around 1.4440 and trade alert section will be updated If we find any buy stops triggered at pullbacks.

Monday, June 06, 2016

Australian dollar trading RBA interest Rate Decison l Bullish outlook

Austalian dollar trading waiting for Bank official to meet and decide the future of Australian Economy, its GDP forecast, bank repo rate, lending rate and deposit rate and it is this is one of the major release that Australian dollar react to. After Friday bull rally, price action in all the Aussie pairs is waiting for banks to hold the cash and lending rate to the record low and maintain a dovish outlook overall as there is some signs of global recovery has been seen in China and other global trading partners.

Technical Analysis of all the Aussie Crosses

As I mention in my previous article, you must be aware of all the recent moves and collect those pieces to be able to know the future reaction of price and it will help you decide when to enter with lower risk and get the maximum reward and remain in trade for longer periods to make full use of risk reward and make profit upto the maximum or close to maximum potential.

Aud/jpy found support just below the previous low

Price Found support around 78.00 just below the previous low and faking out the previous swing low and faking out the strong demand or confluence level of the previous rally which makes a new high, I would like to remain in trade and watch for the next mention target and it is breached i would look for the new high just above the previous swing high.

Australian dollar outlook bullish ahead of RBA rate decision

Outlook is positive for more gains and outlook is still quite bullish But adjusting of large orders can be seen and rally towards the low of 0.7298 cannot be ruled out and from there we can see rally continue towards 0.7450-80 area, which is good area to take profits and put stops under 0.7250 would offer good risk reward potential

Pair Australian Dollar Aud/usd

Entry buy stop at 0.7300

Stops @0.7240

First TG is today high around 0.7380

Second Target is 0.7460

Risk Reward 1/3.

Risk--High

Two things that favors our entry and one of them is we are not entering at market levels and so in bullish market we have to play the waiting game and look for potential large orders for the rally to catch enough sell orders and our stops are placed such as to give trade some room to breathe after the market settles down and second risk is not on as we have not seen big rallies up or down in world indices, so play safe is always recommended and entry and exit level rules are very strict.

Saturday, June 04, 2016

Forex Technical Analysis l How to read a currency Chart

Forex Technical Analysis is complete art in itself and You don't need to be Rocket scientist to read a Currency chart and Your technical knowledge will remain incomplete if you don't know Who hold the strong side on the chart and who is more likely to gain control in future. That market is most sentiment oriented which can turn its hands any time and it would take a session or two for a strong bull or bear trend will completely reverse, so it means you have to be cautious and can take all the time you need to access and implement what you learn in all those months or even years you spend

Forex Technical trading is all about who holds the edge, and if you want to compete with the best in the business, you need to be well versed with all the tools and need to stay ahead of the market

Chart reading or knowledge of complete Price Action is must and your decision making should be based only on levels and time spend near those levels which makes those levels even stronger when they are visit. Market always use to behave near those strong levels even for some spikes, which can be the result of consumed orders or strong pinbars which tell us the strength of the level again.

Step to step Technical Analysis

Chart above Canadian dollar/japanese yen without any explanation will put you in complete disarray what is happening but If I put some text on the same chart the you will have some idea why it is important to read every chart and understands what it is trying to tell and then plan your trading activity. Technical analysis should be easy to read and should only be based on price and its complete supply and demand structure, and time put behind such knowledge always give you an edge above others who use indicators, trendlines, fibo and Chart patterns like Head & shoulders, cup and handle etc.

Also read:--- How I manage to pick bottom in S&P--S&P Technical Analysis

Forex Technical Analysis--Step by Step Chart Reading

Above Chart tells the different story altogether,because every move is cleared in this chart and if you find such decisions been made on the chart the Forex Technical Analysis is logical otherwise they are just support and resistance areas which would surely be one or other way of failure.

If you see the above chart we have supply from where price fell a fair way away and then it found demand and compressed(cp) to supply faking it out and then this CP broke into demand and again faking it out and then rally to new highs which was another fakeout and price fall again.

While price fall of that new high it ignore the demand on its way down,creating new supply and price again found new demand and that first visit to supply (ignore demand become supply)was rejected and price then compressed to newly formed demand faking it out and went quickly for the second visit to supply and when it again went to the demand level which was consumed it just give false pinbar which tells that there was spike due to unfilled order and that unfilled orders now got consumed and price is ready to fall to the next demand level or decision making.

=======================================================================================Tuesday, May 31, 2016

U.S Dollar Index Future l Forex Technical Outlook

Previously:- Dollar Index Future Long Term View

U.S Dollar Index broader outlook, which would cover major currencies like Pound, Euro,Usd/Cad and Usd/jpy

Gbp/usd Intraday Bias of Gbp/usd remains neutral to bearish as today's price seems strong enough for the bias to turn short term bearish and I am watching for a breach of 1.4450 support for a move towards 1.4331.

Speaking of direction in Gbp/usd, which is in strong downtrend on weekly and monthly time-frames but seems to recover well on daily and shorter time frames, but It could turnout to be a small correction of higher time frames.

As I have mention in the chart that price has Fakeout previous two highs and went straight in to supply and that high prove to be vital to cap the bull rally (which seems to be strong enough) as there was a serious buyers trap just above the previous high and today's price action has covered all the buy stops and that minor rally to 1.4650 turned out to be the biggest of buyer's trap pound has offer just recently. I have witness such Price Action in Pound in recent months and those trap rallies really pick momentum going into big impact release like ECB policy decision, as Further stimulus package announce by Mr. Draghi can really put panic in usd bears, so strong rallies can be seen by U.S dollar bulls .

Previously Reason of recent Gold Futures Prices short ralliy

Technical Outlook For the Pound

I will cover the outlook of the Major currencies covered under U.S Dollar Index for the Month of June 2016. Direction outlook for the pound has turned bearish again but I need further Confirmation of the trend as I am still waiting for the lows of 1.4450 to be breached for a move towards possible 1.4045.

You can expect choppy or sideways Price Action for couple of sessions, but still my sell order would remain intact till the weekend and we have still three more days till the market close on Friday and have enough room for the order to click and If things goes right we can surely sees one or couple of the Target get achieved, bearing in mind the volatility to pick up due to high impact release to be scheduled during weekend.

Gbp/usd pending sell stop @1.4450 stops 1.4510

Tg First 1.4310

Tg second 1.4215

Tg Third 1.4090

Eur/USD outlook for the short to medium term is neutral to bearish as We have seen the pair has rejected once again from the highs and has not stopped yet and I would wait and watch If price tests the 1.1060 area in the coming days .

Speaking of direction of Eur/usd, Pair has compressed to the top and recent rejection from the overall supply look strong but recent support around 1.1050-90 area, seems to be holding the pair for too long, but it is understood when High impact release like ECB policy decision is scheduled to be released on Thursday, and Market wanted the view of Mr. Draghi if he is dovish about more stimulus and Gdp forecast for the remaining of the year, would certainly move the pair and there won't be any choppiness for sure.

How to use Open Interest beyond swings on Chart

I prepare this video specially for the newbies and this video is must to watch and part of our Forex Trading Course For beginners, and covers how to use open interest beyond the ultimate swings specially when strong trend reverses immediately.

Recent Rise in U.S Dollar Index and fall in Silver Prices are quite similar to the video mentioned below which has cover most part of my trading techniques, which I used over the years and have edge over other fellow traders.

If I got enough requests then I would post my recent trade of Silver Futures, which I use in the following recommended manner and short Silver Future around 17.75 and my target is 15.60 area.

Trade Watch Pair Gbp/usd

Trade Update Stop out at break even Price went in favor for around 70 pips, but rally strongly after NFP released.

Monday, May 30, 2016

U.S Dollar Index-- DXY long Term View

The US Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies,and it is the most traded currency against all other currencies because USDX is also termed as International Currency and often used as reserves by countries

Usd Dollar Index Weighted Value against other Major Currencies

It is a weighted geometric mean of the dollar's value relative to other select currencies:

*Euro (EUR), 57.6% weight

*Japanese yen (JPY) 13.6% weight

*Pound sterling (GBP), 11.9% weight

*Canadian dollar (CAD), 9.1% weight

*Swedish krona (SEK), 4.2% weight

*Swiss franc (CHF) 3.6% weight

U.S Dollar Index is made up of 6 Currencies, (eventually 24 because 19 of the European Countries who have adopted Euro as their common currency) plus the other major countries like Japan, Sweden, Switzerland and Great Britain and their common currencies.

As mentioned in the above Example with the 19 countries, euro has make up a big chunk of U.S Dollar Index(57.6%), and the next is Japanese yen which is not a big surprise as Japan (13.6%)is also one of the biggest Economies of the world and rest 30% weight of U.S Dollar Index is shared by other four.

One thing that we must kept in mind that you don't need extra skills to trade U.S Dollar Index as You just need to look at sentiment, swings and opportunity to time your trade and If you are having problem accessing situations then U.S Dollar Index can surely give you idea about the direction and things to come and hence you can avoid choppy Market situations. U.S Dollar Index is directly related with U.S GDP and long term bank policy decisions.

Federation Chairman Mr. Ben Bernanke, Apply Quantitative easing or extended stimulus after 2008 Market Crash, For Few years and hence it really stem the U.S Dollar again its counterpart to strengthen economy and print money to put that money in to economy and offer employment opportunities and stimulus package to buy back negative yield bonds and hence strengthening banks and provide them more liquidity or funds to run bank system smoothly.

There are also some interesting facts that when Euro moves, which really moves US dollar index because Euro covers the most portion of USDX, and because USDX is so heavily influenced by the euro, traders have looked to trade Euro as the highest portion of the Currency Volume throughout globally.

How we can use US Index In Trading Currencies

I hope you have got the slightest Idea, "How you can use US Index in your trading?"

If not, you will soon get an idea, as we all know that most of the widely traded currency pairs include the U.S Dollar. IF you still wandering then U.S Dollar based Currencies are Eur/Usd, Gbp/Usd, Usd/jpy, Usd/Chf and Aud/Usd, Usd/Cad

Well, hold your trigger finger and you’ll soon find out! We all know that most of the widely traded currency pairs include the U.S. dollar. If you don’t know, some that include the U.S. dollar are EUR/USD, GBP/USD, USD/CHF, USD/JPY, and USD/CAD.

So, In broader terms If you trade any of these pairs, the U.S index move and if you dont, the US Index will still give you an idea of how weak or strong the U.S Index around the world. In fact, when the market sentiment of U.S dollar is unclear, U.S Index provides you better picture.

As we all know US Index comprised of more than 50% of weighted value of Euro, Euro/Usd chart can be exactly inverse of U.S Dollar Index.

Technical Analyze of USD/jpy

U.S dollar is on the Radar Since there have been talks of Fed Rate Hike and it has picked up since the first rate hike in the last December and hence I always recommend staying long instead of just waiting for things to happen or most of the moves have been finished when the action is performed.

US dollar future to dominate pound exchange rate in coming futureI would like prices of pound sterling to remain in long bearish mode and it could even turn out to be best run of Us dollar future against single currency of U.K. also referred as british pound.US dollar update 4th October 2016.

US dollar bulls very cautious ahead of NFP data I have seen lot of bull rallies of US dollar fake about the recent range and I would like to see this failure again and would look to see the reaction at the low of range again.