In my earlier posts, I always mentioned that we should look to find "Imbalance" to spot the "Institutional activity" in strong trends and shift in value can provide you with another attempts to test the high, specially when trend is strong enough to keep moving back and forth.

As I have mentioned in my previous post that "Australian dollar" is about to break the barrier and it did hold on once again and I was stopped out, and once I was +50(greed to earn more) and I had to cover and stopped out at breakeven and Price has rallied from that area and looking to test the previous zone which could be protected by "Strong holders" which is 0.9210 area. If it holds and price try to accumulate then there is strong chance of momentum carries the price to test the highs, and In strong trends it is strong possibility that price "Gravitates" towards the previous "reference points".

There is a strong chance that price will go through the support zone, but we should look out for with the trend possibility and when you are trading with convictions you should look to back your strengths, and My strength is I never look for reversal too early until there is strong liquidation and couple of attempts have failed.

I also look for candlesticks congestion areas or bullish liquidation traps as there was one yesterday, and price reversal today offered an opportunity but I am not too quick to launch on such scenarios.

Price action building strong trade location here

Blog is about Forex Trading for beginners. . Build forex trading strategies and make a living with Forex Trading.supply and demand price action, supply and demand zones, Price Action Techniques & learn to trade like banks and institutions

Tuesday, June 17, 2014

Australian dollar Intrady technical levels

Intraday trades UPdates

Posting a little update on the usd/chf chart possible congestion candle the last bullish candle and the trade was triggered at 0.8980 and I had to covered the trade around 0.9000 because of slow tempo.

Still there is lot of room but I would like to remain on sidelines ahead of FMOC statement tomorrow and anything can happen but if Fed tap more then we should see rally in usd bulls.

The idea was right look for momentum to carry forward the last day momentum to atleast test the highs and I expected that but due to lack of volitality, the pair seems to pause at the resistance 0.9010

Take a look at the Updated usd/chf chart

I would like to re-enter again if I am given the opportunity to buy low again, but that could seems unlikely because if an area is built then there is unlikely that price visit the previous area.

But to facilitate or through liquidation break it can happen but chances are very rare. Uncertainty drives the market and if price breaks the recent barrier and take out the highs with momentum, then there is strong chance that the trend resume and test multi month high at 0.9110 area and break of 0.9030 will offer good risk to reward.

Monday, June 16, 2014

Extreme support levels In Current Major Currencies

Currently the price action is sideways, may be waiting for Fed to taper more this wednesday, but Our work is not be too much complacent with what would happen will drive the price for surety, as Eur rate cut was welcomed by market and euro found support around 1.3500 area.

But for me I never try to predict what is going to happen or not. I always look around for the pairs which are trending and the reason they go sideways or trend is paused needs confirmation or even if fundamentals does opposite, they do tend to find support to really again .

And that is why I have put a lot of thoughts in to usd/chf chart which has told me that recent rally from the lows could be a hint of big buyers and support zone is strong around 0.8956 and 0.8910 area but I would expect later to protect any strong downside rally, But we need to trade momentum from the located areas on the chart and I would looking to add more to my recent longs around that area again

Take a look at the usdchf update chart . Are we looking at culmination ?

In this chart there is stair stepping trend, which is followed by moving market accumulation and then pair has found support on similar levels it did before, And pending rally still looking for momentum and this could be a start of culmination which means there could be a start of strong trend and we need to keep look to buy on dips, if and When we are offered any such opportunity.

Saturday, June 14, 2014

Price action basic recent update when there was no supply

I have covered most part of these blog with "simple price action when there breakouts followed by neutral day minor developments and has no supply to hold the price to that level", which means that if we see some area is protected by the market strong holders then any spike and downside rally is always strongly protected by those areas.

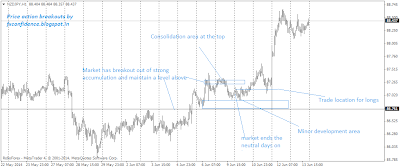

In the following chart I have covered a scenario (the most recent one), where you could tell yourself who is moving the market or who has the control on the price action next move

If you dig deeper than simply following price action, you will understand that supply and demand will drive the market. But supply can be short-term, then transform into demand and vice-e-versa. So, you have to rely on professional supply and professional demand and be able to distinguish it between other fluctuations.

Check this post how reference points works to find good trade locations

Charts often tells you what to do and to trade what you see, but when we relying on other things like candlesticks patterns or any other trading techniques we relying on them rather than we really on what chart trying to tell us and that is what basics of price action pure basics are. When market breakout from a level (Strong accumulation breakouts or range breakouts) and maintain a level above and we strong neutral day and minor development area and then market end the days on lows, then we have to see if there minor protection and development area and look to see the market reaction when price touch that development area again.

In the above chart of nzd/jpy strong trade location were there as there was minor consolidation areas were at the top and market really had no supply below to hold the prices there and the result was followed by strong demand.

Recent price action makes it clear where is ongoing demand

Candlesticks patterns are reliable and work most of them as congestion

I see that many traders create complicated approaches to trading, so I've decided to share with you some simple candlestick patterns that you can use in your trading. But I must warn you that patterns itself are not enough to generate consistent profit. You will easily find conflicting patterns on the same price chart – one signal to the «long» side, one signal to the «short» side. You have to choose between those signals – which would you accept?

So, patterns are not enough. You should sort of «big picture view». You should have idea of where the market is traded right now. I say – «idea», it’s not really «knowledge». Every view we have is considered to be an idea that we have to test – sometimes our ideas are good, sometimes not, but if we build our ideas basing on something that works, we increase our odds of success.

Also, it’s more effective to use those patterns on time-frames starting from H4 and more. The lower your time-frame, the more noise you will have and the less importance candlestick formations have.

By «candlestick formations» I mean something not too complicated. All those «Morning stars», «3 white soldiers» and other conventional candlestick formations create more complexity and push us to predict price action rather than to trade upon what we see.

Also we have at least 4 candlesticks that don’t violate or at least touch high and low of a measuring bar. Duration of average congestion – about 10 bars/candlesticks.

If we register that market is traded within congestion, all trading signals will be of low importance. Price movements within trading ranges can be a result of random move. Nobody really knows what do they indicate.

Also, price will tend to find local reversal points within borders of congestion.

2. Simple continuation pattern.

If you see that price action emerges from congestion or some trading range (and you back up this pattern by understanding that main trend is headed in the same direction), you can use as simple pattern as shown below. First you identify directional bar/candlestick that is considered to have small or no tail at the upper side (for bullish pattern) or at the lower side (for bearish pattern).

Then you simple can divide this candlestick on 4 parts and place your buy limit order at the upper quarter (for bullish pattern) or at the lower quarter (for bearish pattern). Your stop-loss should be set with respect to volatility (say, ATR indicator)

Let me know if this topic is interesting – should we continue talking about that?

Congestion area often give traps or continuation hints

1. Congestion.

Most of the time market holds in congestion. It is a price formation, that is built like shown below. We have measuring bar (candlestick), usually it’s a candlestick with elongated body. High and low of measuring bar become local support and resistance level.