I have covered "reference points" in my previous post in which I mentioned how we can "pick reference point in predicting the next possible move", as there is always a chance of neutral activities after breakouts, which prevent the strong rallies to the downside.

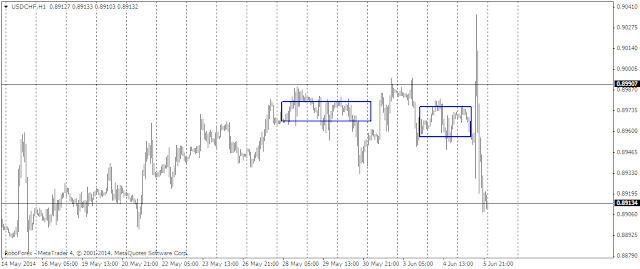

I posted a chart of usd/chf chart on Friday for possible continuation to test the highs after we have some good trade location taking out the "highs".

The chart below is a true indication of institutional activity and when we have some good reference points after breakouts, then strong downside rallies are often "reversed" as In this case.

Recent price action update of usd/chf chart !

Although it is not necessary that we should look for this kind of price action in every strong breakouts because it tends to gravitate to the upside after the end of correction, But the chart which I mentioned above accumulate after that downside rally and strong breakout test was there and that rally pause to take the stops of buyers.

But the important thing is next rally was powerfully to give you second entry and trade location was exactly the low of correction that start from low of bottom.

I have seen some strong buyer is Australian dollar as well will post the chart soon If I got something substantial