Forex Intra-day strategies Should Include enough logic that you can scan multi pairs at a given time, because it gives you the idea to trade Forex According to your strengths and scanning multiple Pairs gives you that benefit. In my View If you trade only few pairs then you try to force the issues to enter forcefully when there is not even a single clue of what is happening and Outlook seems to be Neutral According you Trading Plan.

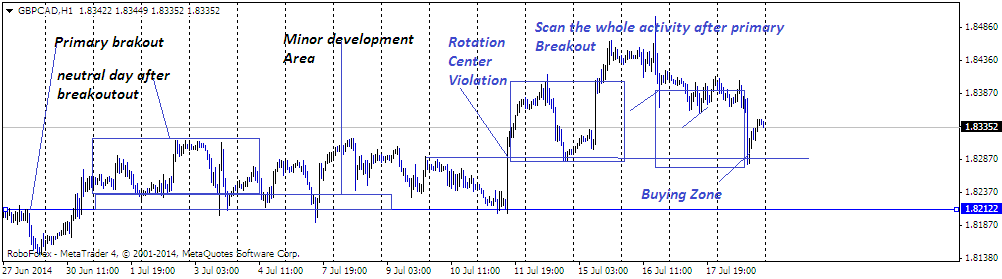

The chart of Gbp/cad tells us that When we have primary breakouts then we should look for Price Behavior as I have mentioned in my earlier post. I strongly believe when after breakout price consolidates for much longer time then it means the price has fade out the momentum and that is a type of activity that is happening in Currencies market to trap traders.

But after we see minor development and when it is tested it found more

"aggressive volumes" and we see violation and another breakout, then it give us hint that in future there is a big chance that this area will be protect (If it is tested) as background tells us enough accumulation and then buying could be distributed in whole trading range which could be the case.

when price test that area we found strong "demand" and We need to be quick to enter and should be aware

"How to cover quickly" with small loss if momentum fade out again but chance of probability that such trade will succeed is more than 50% which should be good enough for a trader to enter as compare to low probability or use of any mechanical system.

See the Gbp/cad Chart Scanning Friday Activity

Blog is about Forex Trading for beginners. . Build forex trading strategies and make a living with Forex Trading.supply and demand price action, supply and demand zones, Price Action Techniques & learn to trade like banks and institutions

Saturday, July 19, 2014

Price Action Basics How to scan the whole actiivty.

Primary Breakout with Minor development Area

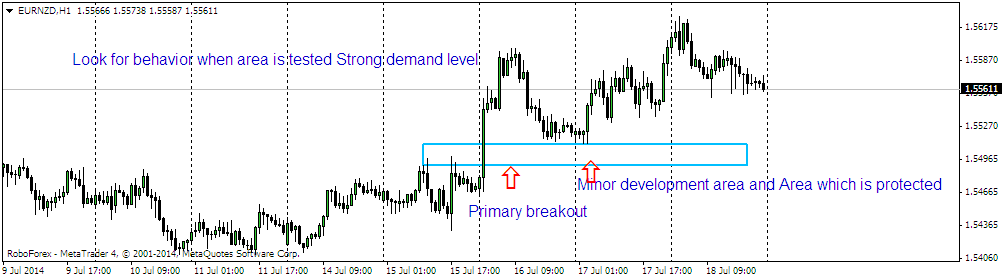

As, I have mentioned in my posts that we should be looking to trade primary breakouts and See If that Breakout will succeed or will fade out the price action. When we line trade for Intraday technicals then this type of forex strategies you should be rely upon that have real logic. we should depend on clues when we see such behavior Like the "Passive Behavior of Sellers After Breakout", "Minor Development Area", "Rotation Center Violation" and neutral days after breakout as these are good clues that whether strong buyers are behind the breakout of it just a retail trader activity.

One thing I always relies on when price behave after testing the Minor development area and It has built some reference point on neutral days, But activity should happened within the next day or two otherwise we could soon see market Liquidate. Chart above is the example of Eur/nzd pair when market has made a primary breakout and we should rely on such trade locations after such activity has happened.

Now If that breakout is not made by strong holders then it will liquidate or Reverse pretty soon But I have strong clues that market will unlikely revisit that Minor development area Or If it did then it will find more buyers and They mark the price again up and trend will resume.

So,the idea post such charts that When we develop as a trader and Start learning everything that drive the market then we should always look to have such Intraday or Swing trading strategies that have logic and reasons to enter or exit should be strong rather than Looking for Indicators to give you clues above "Overbought" or "Oversold" conditions or "Divergence" Which Hardly helps to grow you confidence and profits

Friday, July 18, 2014

Wednesday, July 16, 2014

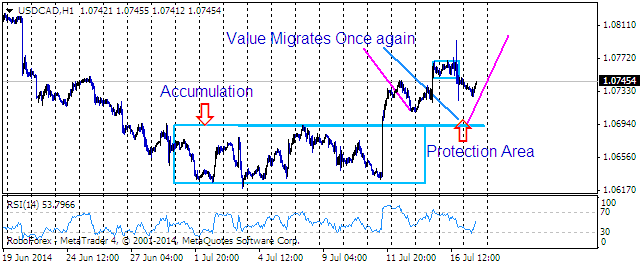

Canadia dollar Trade locations with possible Outcomes Outllook strogly bullish

I posted on Friday that 'Reversal' in trend of Canadian dollar is on the cards and According to my Forex Intraday Trading strategies I would like to remain bullish on the pair. After I posted, Price break the point of equilibrium straight away and Now I am posting two charts with two possible outcomes. With BOC not a lot concerned about the 'BOC Policy Decision', and they are ready to enjoy its weakness for Growth and Recovery.

Take a look at the Chart of Canadian Dollar Hourly Chart

Tuesday, July 15, 2014

Forex trading Price action based on supply and demand Levels

As Long as charts are not Uploading on my blogs, I have used My youtube channel to let you explain the reason of entry and exit and that video was posted on my Youtube channel yesterday and It has behave the same way which I have anticipated.

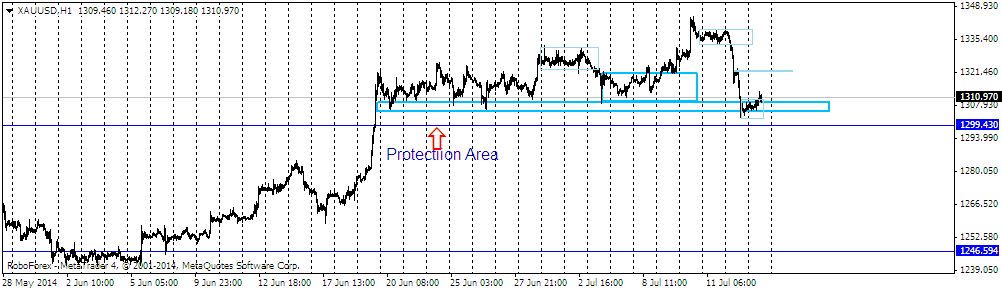

Gold Updates As we have some strong accumulation

I would like to update the Gold chart as I have seen some "Strong accumulation" before the next move. In Forex trading "Momentum can reverse the trend but Only In Forex we have some strong supply and demand Scenarios which makes this place full of opportunities. My "Intraday Forex trading strategies" always tell me what I am doing and Why I am making such Observations. If you have strong downside rallies ahead of strong "Protection Area", then need to have first clue of price holding downside pressure.

In this case we have some strong protection area after the breakout(upside) around 1298.00 and After price manage to hold the higher price so strongly for few days It build up some strong "Reference Points" Marked by blue rectangle and the upside rally sustained after the test of "Accumulation Zone", the price has again start reacting at lows and also holding further downside rallies.

I would rather recommend and test of lows of failed with strong momentum coming in again and we have only one supply zone which is around "1321" and then "1336". Risk is not that much when we see any momentum coming but reward is very good and that what should be the case while we trade any currency or metal to offer you strong reward and low risk

Take a look at the updated gold Chart

In this chart shaded blue rectangles are the trade locations which strongly hints about the test of atleast supply zone on Intra-day basis and Price is still in range after the strong downside rally yesterday and I would recommend you to see whether we see strong breakout and test of the range and continuation of "Uptrend".

Friday, July 11, 2014

Candadian Dollar spike of daily Demand Zone Outlook Bullish

Canadian Dollar spike from the several months low was due to strong demand area as it was the are just above the protection area which is 1.0560. Risk aversion hit the market when Canadian Banks released their monthly Unemployment Data, which tells that unemployment rise during last month and rate went upto 7.1% as market was anticipating no change.

For me It is a strong hint that market has complete the correction or it could be reracement as well but In elongated trends, this type of behavior is very much on the cards and Price go through the 1.0680 supply zone with conviction and strength.

I would really try to take a closer look if that "Supply Zone" is tested again and this cross will be on the priority list to trade.

usd/cad Bounce of strong demand zone Outlook strong bullish Take a look at usd/cad Daily Chart below

I did enter after strong momentum candle spike off the lows and It could be a start of new trend again and that is why always trust and momentum and take one pair at a time specially when it One Time Frame Move (OTF)