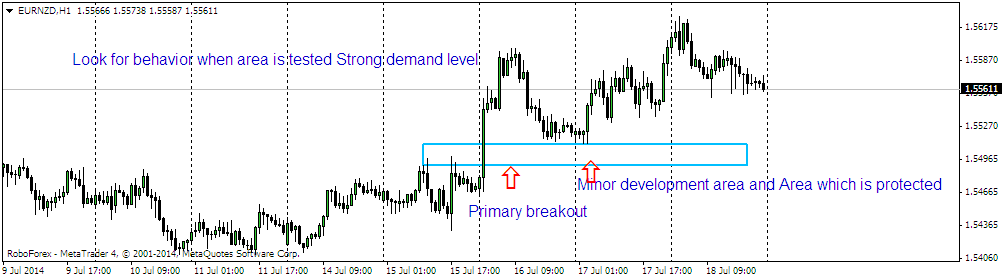

As, I have mentioned in my posts that we should be looking to trade primary breakouts and See If that Breakout will succeed or will fade out the price action. When we line trade for Intraday technicals then this type of forex strategies you should be rely upon that have real logic. we should depend on clues when we see such behavior Like the "Passive Behavior of Sellers After Breakout", "Minor Development Area", "Rotation Center Violation" and neutral days after breakout as these are good clues that whether strong buyers are behind the breakout of it just a retail trader activity.

One thing I always relies on when price behave after testing the Minor development area and It has built some reference point on neutral days, But activity should happened within the next day or two otherwise we could soon see market Liquidate. Chart above is the example of Eur/nzd pair when market has made a primary breakout and we should rely on such trade locations after such activity has happened.

Now If that breakout is not made by strong holders then it will liquidate or Reverse pretty soon But I have strong clues that market will unlikely revisit that Minor development area Or If it did then it will find more buyers and They mark the price again up and trend will resume.

So,the idea post such charts that When we develop as a trader and Start learning everything that drive the market then we should always look to have such Intraday or Swing trading strategies that have logic and reasons to enter or exit should be strong rather than Looking for Indicators to give you clues above "Overbought" or "Oversold" conditions or "Divergence" Which Hardly helps to grow you confidence and profits