I see that many traders create complicated approaches to trading, so I've decided to share with you some simple candlestick patterns that you can use in your trading. But I must warn you that patterns itself are not enough to generate consistent profit. You will easily find conflicting patterns on the same price chart – one signal to the «long» side, one signal to the «short» side. You have to choose between those signals – which would you accept?

So, patterns are not enough. You should sort of «big picture view». You should have idea of where the market is traded right now. I say – «idea», it’s not really «knowledge». Every view we have is considered to be an idea that we have to test – sometimes our ideas are good, sometimes not, but if we build our ideas basing on something that works, we increase our odds of success.

Also, it’s more effective to use those patterns on time-frames starting from H4 and more. The lower your time-frame, the more noise you will have and the less importance candlestick formations have.

By «candlestick formations» I mean something not too complicated. All those «Morning stars», «3 white soldiers» and other conventional candlestick formations create more complexity and push us to predict price action rather than to trade upon what we see.

Also we have at least 4 candlesticks that don’t violate or at least touch high and low of a measuring bar. Duration of average congestion – about 10 bars/candlesticks.

If we register that market is traded within congestion, all trading signals will be of low importance. Price movements within trading ranges can be a result of random move. Nobody really knows what do they indicate.

Also, price will tend to find local reversal points within borders of congestion.

2. Simple continuation pattern.

If you see that price action emerges from congestion or some trading range (and you back up this pattern by understanding that main trend is headed in the same direction), you can use as simple pattern as shown below. First you identify directional bar/candlestick that is considered to have small or no tail at the upper side (for bullish pattern) or at the lower side (for bearish pattern).

Then you simple can divide this candlestick on 4 parts and place your buy limit order at the upper quarter (for bullish pattern) or at the lower quarter (for bearish pattern). Your stop-loss should be set with respect to volatility (say, ATR indicator)

Let me know if this topic is interesting – should we continue talking about that?

Congestion area often give traps or continuation hints

1. Congestion.

Most of the time market holds in congestion. It is a price formation, that is built like shown below. We have measuring bar (candlestick), usually it’s a candlestick with elongated body. High and low of measuring bar become local support and resistance level.

Blog is about Forex Trading for beginners. . Build forex trading strategies and make a living with Forex Trading.supply and demand price action, supply and demand zones, Price Action Techniques & learn to trade like banks and institutions

Saturday, June 14, 2014

Candlesticks patterns are reliable and work most of them as congestion

Thursday, June 12, 2014

Strong signs of Paradigm Shifts

As, I mentioned in the last part of my trade updates about Australian dollar can continue the rally, and It give me confidence after decline in unemployment in OZ area still giving boost to Australian dollar and Longs were triggered around.

The best part of this activity is that liquidation break has been faded out and price has taken the highs out and Now just consolidation and holding higher prices, which is also a good clue if it is followed by a test of trade location during the release yesterday.

If you want to get good price and capture a reversal of correctional trend(as you can see price spike off minor development area from the lows which is mentioned in blue rectangle), you should seen signs of real support. Real support creates conditions for a reversal if market goes against big buyer, as I mentioned when big buyers are holding the prices at highs and create trade locations and then we see strong selling as market goes against them in this case. (remember –to reverse the market, there should be supply/demand imbalance). Reversal occurs after paradigm shift, when it becomes clear for most short sellers that they were biased and go in the wrong direction.

In such case, we most often see imbalance in price action, when market has already create a development area and end the day on lows, then next day or two we saw strong accumulation and rejection from the prior day low, the suddenly paradigm shift and strong continuation of the trend is seen.

Australian dollar can break through any time

Tuesday, June 10, 2014

Reference points involvement in predicting next possible move

I have covered "reference points" in my previous post in which I mentioned how we can "pick reference point in predicting the next possible move", as there is always a chance of neutral activities after breakouts, which prevent the strong rallies to the downside.

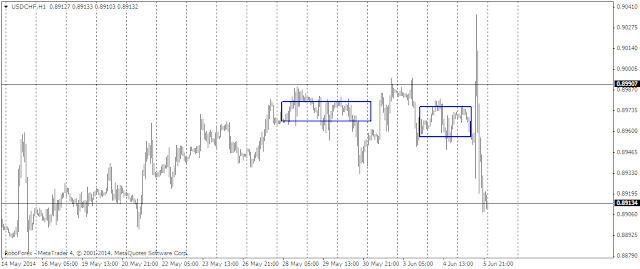

I posted a chart of usd/chf chart on Friday for possible continuation to test the highs after we have some good trade location taking out the "highs".

The chart below is a true indication of institutional activity and when we have some good reference points after breakouts, then strong downside rallies are often "reversed" as In this case.

Recent price action update of usd/chf chart !

Although it is not necessary that we should look for this kind of price action in every strong breakouts because it tends to gravitate to the upside after the end of correction, But the chart which I mentioned above accumulate after that downside rally and strong breakout test was there and that rally pause to take the stops of buyers.

But the important thing is next rally was powerfully to give you second entry and trade location was exactly the low of correction that start from low of bottom.

I have seen some strong buyer is Australian dollar as well will post the chart soon If I got something substantial

Monday, June 09, 2014

Basic convictions of technical analysis

I would say, it’s true in the first part – price reflects it all, what about 2 other? Will trends continue and will history repeat itself? It’s a big question because nobody knows what «trend» is for example.

Some people draw «trend lines», but more often than not they provide information that is already useless. Trend line shows trend when it is already confirmed, therefore it has lower odds for continuation.

Traders also use support and resistance, but it works only when strong demand or supply drives the market. Those technical methods will not help you identify strong supply and demand – the fact that price has touched some level twice is not the indication of strong demand.

But what is that?

Einstein once said that you can’t solve the problem using mindset that created this problem. To combine information that price gives us, we should apply one more parameter, and this parameter is time.

Of course you are using it in some ways, but traders often don’t use in consciously.

What time gives us?

Time is one of components of value. The more time we have, the more value we can create. Simple example is interest rate. If you put some money in the bank, interest rate multiplied by time will increase your capital.

The same is in trading. The more time market spends near some given level, the more this level is validated.

There are some clues when you employ parameter of time compared to parameter of price.

Corrections are not deep enough.

On screenshot below you see no spikes on the way down:

Trend is likely strong if:

Usually they don’t exceed 25% of previous move up.

It means that strong buyers are probably dominating. To make things clear – by strong buyers I mean «buyers with distant stops», not «buyers with unlimited pockets». But more often than not those who can move the market and yet have distant stops are huge enough, be sure about that.

Why does it work that way? If you see weak buyers involved, they would liquidate quickly and market will go after their stops – you will see rapid «spikes» on the way down.

I will cover more on this topic in the days to come ! Keep Checking for Updates

Thursday, June 05, 2014

Types of Swing trading.

What is swing trading? How "swing trading" differs from «momentum trading»? Actually, there are many approaches to swing trading, but I will express my point of view on the subject.

Swing trading is trading on intervals more than 1-3 days, some traders may call it «long term» or «medium term», but in fact, good swing trade can last no more than 4-5 days. Swing trades are usually level-based trades.

For example, if you trade momentum, you can capture short-term overbought or oversold condition of the market (imbalance) and trade-off scenario of inventory correction.

Swing trading basic based on rejections and hotspots areas

I basically trade 2 types of swing trades – «rejection trades» and «hot spot trades»

How do they look like?

In this post I will talk about "rejection trades".

Briefly, rejection is a reversal. It’s that simple. But there’s one small nuance. Rejection level is not a «support» or «resistance» level. Actually, there are no support and resistance levels – there are only areas of support and resistance. And they are usually located where majority of traders don’t seek them.

Important principle:

Before ever considering fading correctional move, you should see signs of support/resistance before. Sun Tzu had said: «Every battle is won before it’s ever fought»

The same is in trading. Every reversal is made before it’s occurred. Weird, huh?

Reversal is just a paradigm shift in heads of market participants. Before reversal, market must have strong imbalance between demand and supply, otherwise no power can drive the market against existing trend (even correctional)

So, to decide whether to join a trend or not, you should see signs of big money buyer (seller). As you know, institutional buyer will tend to accumulate, to slowly build his position. More often than not those guys are not speculators in conventional way – they accumulate position by given price, then use purchased asset in business outside the market.

So, if you see that market tends to show you very well traded levels in the center of the day and poorly traded levels on the extremes of the day, it can be a sign of accumulation if this process goes long enough.

Look at the chart of usd/chf – you have seen signs of big buyer accumulating long here – look how price is leaning to the area 0.8970. How do you think – why market shows strange consensus around this level?

Also, you expect to see «neutral» or «normal» days as the process of accumulation goes on. Neutral day is day with very low tempo and aggressiveness – it closes near its open. Normal day is more aggressive day, yet it also closes near its open. These days also help you find accumulation areas on the chart

Usd/chf update

New Usd/chf chart update

As I mention earlier in my post, sometimes it is easy to find reference points rather than mere support and resistance and current rally is a example of that and Price was willing to rally after strong consolidation for days and that is where we should stay alert.

Are we seeing another attempt before ECB decision

USD/CHF Intra-day Technical update . Are we seeing another rally

There are some things that mostly day-traders do and rarely (if not never) other time-frame traders do. As an example - reaction on short-term reference points.

Price action indicates - what market does right now, but we need to know not only that, but - what to expect from the market? What can we anticipate?

While we analyze any chart, we first rely on the recent price action and rely on reference points, which are short term location where price lean after break out, Candlesticks chart or support and resistance traps are quite often ( I don't think that there are any such strong and resistance area as there are extremes and rejection areas and it is important for us to know how market react after breakouts)

With candlesticks, I don't trust any patterns as there are often strong breakouts are followed by reversals,Big buyers used Candlesticks against the strong trend to reverse the price for liquidation purpose and to trap the traders who don't know what is "Context" and what market tells you to do after such a candle appears and price did not follow through or pause for few sessions.