Its been target oriented week for usd/cad and Aud/cad pairs and Now the focus from there shift after the news section settles down and we can see new cash flow in the Currency market as talk shift to Fed's september rate hike after upbeat Non Farm Payroll last Friday. I have prepared a report on Euro dollar, pound dollar and commodities.

Fibonacci Retracement levels for gold futures

Weekly chart of the Gold Futures refers to unfold correction and retracement levels towards 38.2% and If we see an rejection from here then probably we will witness a impulsive rally towards 1295 levels and from there we will see how price unfolds and If this assumption is right and we see a break below 1295 level and this will confirm the top and our next target would be 1250 and 1198 level in coming weeks. But we will have to be patient and wait for the price action to show some sign of top.

Read Gold futures price Chart and understand every move

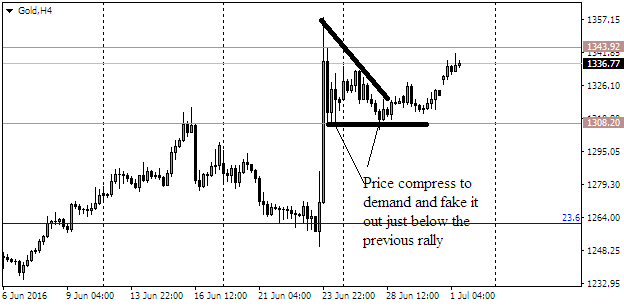

Gold futures has some strong history and open interest at historic level where price had fakeout the bull rally and strong rally after clearing supply with every move was a clear signal of new buyers found there at level and that is what I try to mention in the chart and Video below will really help you understand the "law of open Interest" at historic price action level and Now we need further price action to see if Price has reached the motive or target smart money was looking for and I would post an update If we see another level of interest or trading opportunity.