First take a look the post Which I posted This weekend

click here

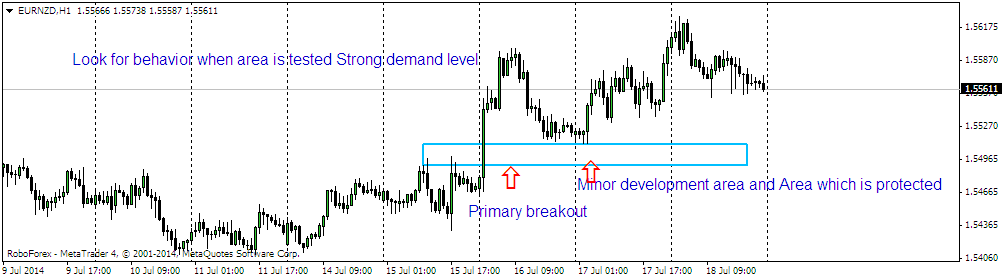

Price opened up with a big downside gap which was quite elongated in this type of scenario and should be ignored in overall context. But the most important part was that price found strong momentum off the lows when it test the breakout area or Minor development area (which was same in this case) as it rarely happens . There was long sideways movement for a complete day but it protect the earlier lows which is a good sign of price finally test the supply at 1.5694.

Take a look at the updated chart of Eur/nzd