Its quite a while since I have updated blog with the technical after I took my half of profit of my trade usd/jpy past Monday, But that was a risky choice as we were in the strong downtrend but Intraday less opportunity to pick up reversal can offer splendid opportunity once it really hit the trigger.

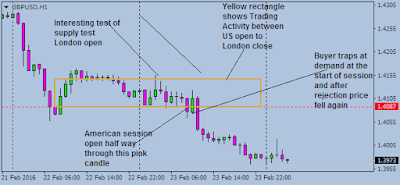

In my recent Post, I am about to post charts of Pound and Crude where I have mentioned How to read a price chart with session by session activity and serious participation of strong holders can easily be spotted out at the start of session or at the end of most active session through the day.

Take a look at pound Chart

Amount of time i spend in trading supply and demand and reading session activity fits exactly to that trade when We have such Neutral activity happen through a session starts to next day session, then the next move is should be watched with absolute care and timing to pull the trigger should be at the exact time and stops and targets should always be decided.

Technical pick of the Week Crude Shorts

These two trade went according to plan and timing and selection of trading pairs was just excellent. Later during the day I would post how to find Imbalance on daily charts and How working against support and resistance can do wonders for you and You just need to remain focus with recent Gbp/Usd crashes from the open is excellent example of why I am not a very big fan of support and resistance while looking for big profits and excellent risk rewards