Gold Comex Updates

I would like to update the Gold chart as I have seen some "Strong accumulation" before the next move. In Forex trading "Momentum can reverse the trend but Only In Forex we have some strong supply and demand Scenarios which makes this place full of opportunities. My "Intraday Forex trading strategies" always tell me what I am doing and Why I am making such Observations.

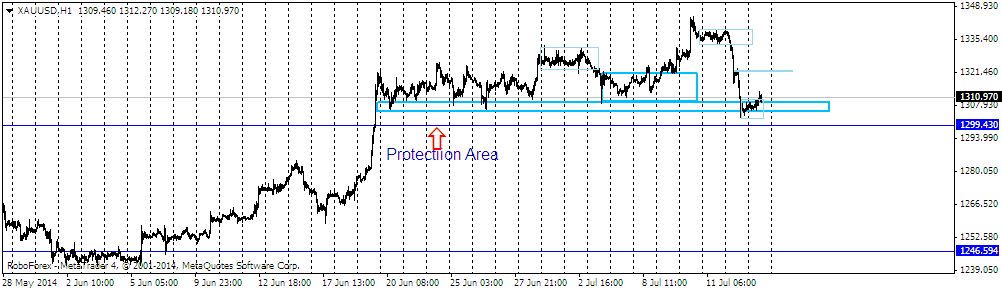

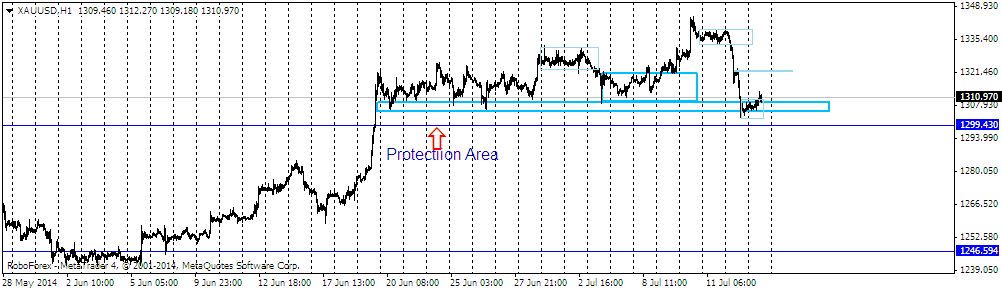

If you have strong downside rallies ahead of strong "Protection Area", then need to have first clue of price holding downside pressure.

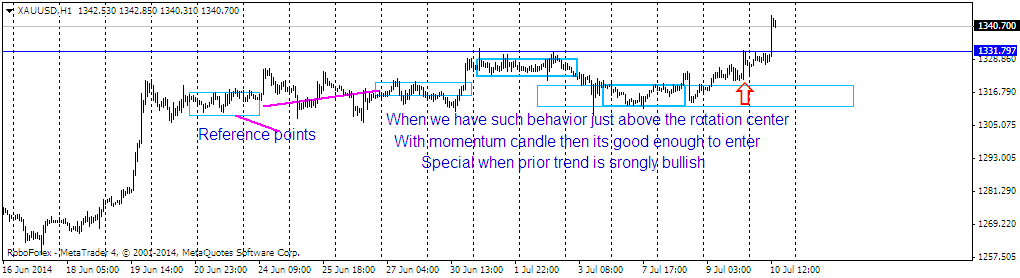

In this case we have some strong protection area after the breakout(upside) around 1298.00 and After price manage to hold the higher price so strongly for few days It build up some strong "Reference Points" Marked by blue rectangle and the upside rally sustained after the test of "Accumulation Zone", the price has again start reacting at lows and also holding further downside rallies.

I would rather recommend and test of lows of failed with strong momentum coming in again and we have only one supply zone which is around "1321" and then "1336". Risk is not that much when we see any momentum coming but reward is very good and that what should be the case while we trade any currency or metal to offer you strong reward and low risk

Take a look at the updated gold Chart

In this chart shaded blue rectangles are the trade locations which strongly hints about the test of atleast supply zone on Intra-day basis and Price is still in range after the strong downside rally yesterday and I would recommend you to see whether we see strong breakout and test of the range and continuation of "Uptrend".