Hi traders! Everbody knows one of basic principles of technical analysis – price reflects everything. Let’s think about it for a while. Many traders are caught in the price action and ask – «what in the world does it (price) reflect?».

If fact, market needs some time to reflect demand and supply in the price action.

This is a weekly chart and you see that price action here really reflects activity of all major players who are interested in this market. This is big timeframe and takes 1 week to complete this figure. Strong side of the market (smart money, market movers) is automatically visible after bar (candlestick) is closed. If buyers were dominating the market, we see rising bar (candlestick), if sellers were dominating – we see declining bar (candlestick) e t.c. In this particular situation, we see that buyers were in control.

We immediately register much more ambiguity, volatility and uncertainty. Price goes back and forth. No one would say with confidence who is in control here.

So, we come to conclusion that, yes, price reflects everything but it needs some time to do that. On small timeframes price becomes advertising mechanism that fluctuates from high to low prices to attract buyers and sellers for whatever reasons. What does it mean that price is an “advertising mechanism»? It simply means that goal of the marketplace – to bring together buyers and sellers, to facilitate trading.

Market works as an auctioneer. Imagine some auctioneer that tries to sell something to the public. What will he do? He will claim starting price and if no one is interested, he will claim lower price until any buyer is interested. That’s how market operates, nothing new about this.

If you want to purchase something, will you blindly buy something just for the reason that it is advertised? No, you will not do that. You want to know fair price, in other words, you want to know not only price but also value. You don’t want to buy something overpriced. That’s a main difficulty of technical analysis. It’s been said that price reflects everything, but we see it only in retrospective. In real time we see semi-stochastic process of price action going back and forth.

Find where the value is

To avoid being trapped by the price, traders needs to know where the value is. In a nutshell, value is a area of acceptance, area where all timeframes are comfortably trading with each other.

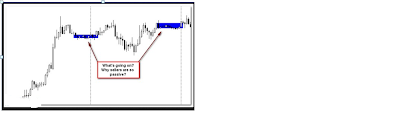

To find value, you should pay some attention to parameter of time. The more time price spends near certain price level, the more accepted this level is. For example, on a sample below we see that market was holding certain high prices within some period of time, and when price tries to get away from this level, market rejects is:

However, time also is a double-edged sword. Too much time time spent near price level means that market is preparing for big move (thus, is not going to stay near this level):

Sometimes it’s hard to identify value. It’s not easy process and sometimes market will rotate waiting for more information.

Market profile

The most convenient tool that allows us to see how value migrates, is market profile. It is a tool that organizes data using distribution as a core principle. It shows – how much time price was touching every level within a trading day and builds «value area». Value area is an area that combines 70% of data within one blue rectangle. This is an area of acceptance. When price emerges from this area, it will most likely revisit this area again. But there are times when market builds new value higher of lower without revisiting former value areas. We call it a trend