Candlesticks patterns in overall price action patterns

I see that many traders create complicated approaches to trading, so I've decided to share with you some simple candlestick patterns that you can use in your trading. But I must warn you that patterns itself are not enough to generate consistent profit. You will easily find conflicting patterns on the same price chart – one signal to the «long» side, one signal to the «short» side. You have to choose between those signals – which would you accept?

So, patterns are not enough. You should sort of «big picture view». You should have idea of where the market is traded right now. I say – «idea», it’s not really «knowledge».

Every view we have is considered to be an idea that we have to test – sometimes our ideas are good, sometimes not, but if we build our ideas basing on something that works, we increase our odds of success.

Also, it’s more effective to use those patterns on time-frames starting from H4 and more. The lower your time-frame, the more noise you will have and the less importance candlestick formations have.

By «candlestick formations» I mean something not too complicated. All those «Morning stars», «3 white soldiers» and other conventional candlestick formations create more complexity and push us to predict price action rather than to trade upon what we see.

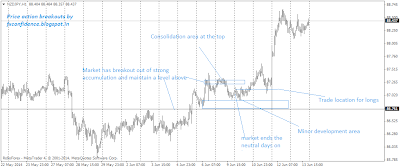

Congestion area often give traps or continuation hints

1. Congestion.

Most of the time market holds in congestion. It is a price formation, that is built like shown below. We have measuring bar (candlestick), usually it’s a candlestick with elongated body. High and low of measuring bar become local support and resistance level.

Also we have at least 4 candlesticks that don’t violate or at least touch high and low of a measuring bar. Duration of average congestion – about 10 bars/candlesticks.

If we register that market is traded within congestion, all trading signals will be of low importance. Price movements within trading ranges can be a result of random move. Nobody really knows what do they indicate.

Also, price will tend to find local reversal points within borders of congestion.

2. Simple continuation pattern.

If you see that price action emerges from congestion or some trading range (and you back up this pattern by understanding that main trend is headed in the same direction), you can use as simple pattern as shown below.

First you identify directional bar/candlestick that is considered to have small or no tail at the upper side (for bullish pattern) or at the lower side (for bearish pattern).

Then you simple can divide this candlestick on 4 parts and place your buy limit order at the upper quarter (for bullish pattern) or at the lower quarter (for bearish pattern). Your stop-loss should be set with respect to volatility (say, ATR indicator)

Let me know if this topic is interesting – should we continue talking about that?