«Thing that hasn’t happened is sometimes more important in the market than thing that has happened»

I want to start this thread with this strange sentence. We will talk about trading logic. How do you make decisions? Do you look for signs of buyer and seller and act accordingly?

Think about simple thing –price action itself (trend, movement) will not allow you to benefit from that. Some movements are continued, some are reversed.

It depends on current market conditions, but probability of success will be close to 50/50 if you simply follow price action (substract spreads and rapid volatility spikes and you will get perfect strategy for failure).

So, what works?

If you dig deeper than simply following price action, you will understand that supply and demand will drive the market. But supply can be short-term, then transform into demand and vice versa. So, you have to rely on professional supply and professional demand and be able to distinguish it between other fluctuations. all that we learn here is designed for that. Professional demand (or supply) in most cases is ongoing demand. But are we naive enough to think, that professional buyer will uncover his actions for you in easy identifiable and straightforward way? No, they don’t do that!

There are numerous attempts to capture signs of professional activity using volumes. Some traders think that if they have volumes, they have real information. Poor guys!

Volumes are also misleading. So, one can not be successful in trying to capture big buyer from the market… if he thinks in conventional way.

Market tells you a story and you should understand this story, combining nuances and clues (even number of volumes if you like) in the whole picture.

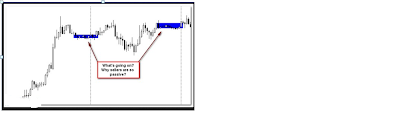

<

2. There’s neutral day after the breakout. If there were short-term traders who have made this breakout, they would liquidate pretty soon. But nothing happens –nothing at all! All day price goes back and forth with very low tempo. It means that probably those buyers were big (institutional) buyers.

Every time you analyze the market, you make narrative. Be sure that your narrative is reasonable and relies on solid market logic.

There are some important principles:

1. Institutional buyers will sell on the upside breakout (not downside)

2. Low volatility after high volatility (directional breakout) shows lack of participation. The less liquidity (participation) we have near current levels, the more odds that market will auction higher.

Is it complex?

Yes, it is. But this is mindset that requires from you some disbelief, some critical view, some commitment to dig deeper and see what is hidden. That what trading is about.

Price action basics.

Not surprisingly price breaks out to the upside again.

Blog is about Forex Trading for beginners. . Build forex trading strategies and make a living with Forex Trading.supply and demand price action, supply and demand zones, Price Action Techniques & learn to trade like banks and institutions

Showing posts with label Basics of price action and Swing trading. Show all posts

Showing posts with label Basics of price action and Swing trading. Show all posts

Saturday, May 03, 2014

price action basic and swing trading

Subscribe to:

Comments (Atom)